The dream of owning a home – a sanctuary, an investment, a legacy – resonates deeply within the heart of every Indian. It’s a milestone etched in our aspirations, a symbol of security and belonging. But the journey from dreaming to holding those coveted keys can often feel like navigating a complex maze. Fear not, aspiring homeowner! As a seasoned real estate expert with years of experience across the diverse Indian landscape, and a deep understanding of the West Bengal market, I’m here to illuminate your path.

This comprehensive guide, crafted with meticulous research and practical insights, will serve as your trusted companion in making this significant decision. We’ll delve into the crucial aspects of buying a home in India, ensuring you’re equipped with the knowledge and confidence to make an informed choice. Whether you’re a first-time buyer or looking to expand your property portfolio, understanding these fundamental principles is paramount.

Why This Guide Matters: Navigating the Indian Real Estate Landscape

India’s real estate market is a vibrant tapestry, woven with diverse regulations, regional nuances, and a plethora of options. What works in bustling Mumbai might differ significantly in the serene backwaters of Kerala or the rapidly developing suburbs of Kolkata. This guide aims to provide a pan-Indian perspective while keeping in mind the specific considerations often encountered in markets like West Bengal.

Search terms like “Home Buying Guide,” “Things to Keep in Mind While Buying a New Home,” and “Home Buying Tips” reflect the common anxieties and information needs of prospective buyers. This blog is designed to address these very concerns, offering clarity and actionable advice.

Step 1: Laying the Foundation – Self-Assessment and Financial Planning

Before you even begin browsing properties, the most crucial step is introspection and meticulous financial planning. Buying a home is not just an emotional decision; it’s a significant financial commitment that will shape your future.

- Understanding Your Needs vs. Wants: This is where the dream meets reality. Ask yourself: What are your absolute necessities in a home? (e.g., number of bedrooms, proximity to workplace/school, basic amenities). What are your desires? (e.g., a balcony with a view, a home theatre, specific architectural style). Distinguishing between these will help you narrow down your search and budget effectively. For instance, in a city like Kolkata, prioritizing proximity to public transport might be a need, while a sprawling garden might be a want, especially if budget is a constraint.

- Assessing Your Financial Capacity: This is the bedrock of your home-buying journey.

- Income and Savings: Evaluate your current income, stability, and existing savings. How much can you realistically allocate towards a down payment? In India, the typical down payment ranges from 10-20% for under-construction properties and can go higher for ready-to-move-in ones.

- Loan Eligibility: Understand your home loan eligibility. Factors like your income, credit score, existing debts, and age will determine the loan amount you can secure. Explore different lenders and their eligibility criteria. Banks and NBFCs in West Bengal, for example, might have specific schemes and interest rates.

- Budgeting for Additional Costs: The cost of buying a home extends beyond the property price. Factor in stamp duty, registration charges (which vary significantly across states like West Bengal), brokerage fees (if using an agent), home insurance, and initial furnishing costs. A comprehensive budget will prevent financial surprises down the line.

- Credit Score Check: Your credit score is a critical factor in loan approval and interest rates. Obtain your credit report from agencies like CIBIL, Experian, or Equifax and address any discrepancies or issues. A good credit score can save you a significant amount in interest over the loan tenure.

Step 2: The Quest Begins – Researching Location and Property Type

Once your financial foundation is solid, the exciting part begins – exploring potential locations and property types. This stage requires thorough research and a pragmatic approach.

- Location, Location, Location: This age-old adage holds immense truth in real estate. Consider factors like:

- Proximity to Workplace and Educational Institutions: This impacts your daily commute and quality of life. For families in areas like Salt Lake or Rajarhat in Kolkata, proximity to good schools and IT hubs is often a top priority.

- Infrastructure and Connectivity: Assess the availability of essential infrastructure like roads, public transport (metro, buses, local trains – crucial in West Bengal), water supply, electricity, and sanitation. Future infrastructure projects can also significantly impact property value.

- Social Amenities: Consider the presence of hospitals, markets, shopping malls, recreational facilities, and community spaces. A vibrant social infrastructure enhances livability.

- Safety and Security: Research the crime rates and safety measures in the area. A secure environment is paramount for peace of mind.

- Future Development Potential: Areas with planned infrastructure upgrades or commercial developments often witness higher appreciation in property values. Keep an eye on government announcements and local development plans.

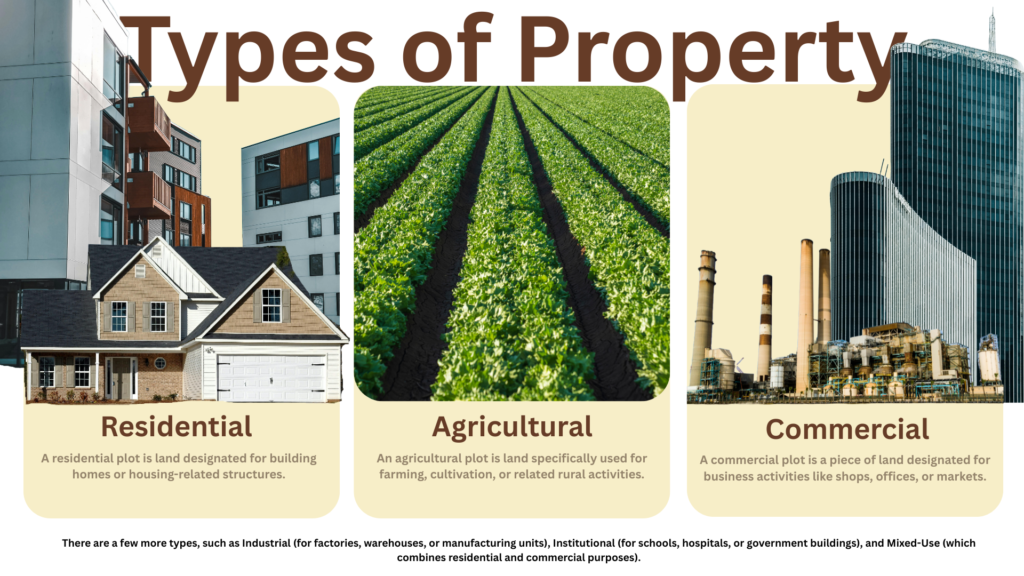

- Choosing the Right Property Type: India offers a diverse range of property options:

- Apartments/Flats: Common in urban areas, offering a community living experience and often more affordable than independent houses. Consider the size, amenities, and maintenance charges. In cities like Kolkata, you’ll find a wide range of apartment complexes, from budget-friendly to luxury.

- Independent Houses/Villas: Offer more privacy and space but usually come with a higher price tag and maintenance responsibilities. Popular in suburban areas and smaller towns.

- Row Houses/Bungalows: A hybrid option offering a blend of independence and community living.

- Plots/Land: Investing in land requires a different perspective, focusing on long-term appreciation and potential development. Be aware of land regulations and zoning laws.

- Online Portals and Physical Visits: Utilize online real estate portals to get an overview of available properties and price trends in your desired locations. However, nothing beats physical site visits to assess the actual condition, surroundings, and feel of the property. Don’t hesitate to visit multiple properties before making a decision.

Step 3: The Legal Labyrinth – Due Diligence is Non-Negotiable

The legal aspect of property buying in India is often perceived as daunting, but meticulous due diligence is your shield against potential pitfalls.

- Title Verification: This is the most critical step. Ensure the seller has a clear and marketable title to the property. Engage a competent lawyer to examine the chain of ownership, previous sale deeds, and any existing encumbrances (loans or legal disputes). In West Bengal, checking land records with the Directorate of Land Records and Surveys is crucial.

- Approvals and Sanctions: For under-construction properties, verify that the builder has obtained all necessary approvals from the relevant authorities (e.g., municipal corporation, town planning authority). Check for building plan sanctions, environmental clearances, and commencement certificates. RERA (Real Estate Regulatory Authority) registration is mandatory for most projects and provides a layer of protection for buyers.

- RERA Compliance: The Real Estate (Regulation and Development) Act, 2016, aims to protect homebuyers’ interests. Ensure the project you’re considering is RERA registered. You can check the RERA website of the respective state (e.g., WB-RERA for West Bengal) for project details, builder information, and timelines.

- Encumbrance Certificate: Obtain an Encumbrance Certificate (EC) from the sub-registrar’s office. This document confirms whether the property has any registered charges or liabilities against it.

- Property Taxes and Bills: Check for any outstanding property taxes or utility bills. Ensure the seller has cleared all dues before the sale.

Step 4: The Transaction – Making the Offer and Closing the Deal

Once you’ve found your dream property and completed your due diligence, it’s time for the transaction.

- Making an Offer: Work with your agent (if you have one) to make a formal offer to the seller. This offer will include the agreed-upon price, payment terms, and timelines.

- Negotiation: Be prepared to negotiate the price. Research prevailing market rates in the area to make an informed counter-offer if necessary.

- Sale Agreement: Once the offer is accepted, a Sale Agreement (Agreement for Sale) is drafted. This legally binding document outlines the terms and conditions of the sale, including the property details, sale price, payment schedule, and possession date. Have your lawyer review this agreement thoroughly before signing.

- Payment Schedule: Understand the payment schedule, especially for under-construction properties. Payments are usually linked to construction milestones. Ensure these milestones are clearly defined in the Sale Agreement.

- Home Loan Disbursement: If you’re taking a home loan, the bank will conduct its own valuation and legal checks before disbursing the loan amount as per the agreed-upon schedule.

- Registration of the Sale Deed: The final step is the registration of the Sale Deed at the sub-registrar’s office. This officially transfers the ownership of the property to you. You will need to pay stamp duty and registration charges at this stage. Ensure all necessary documents are in order, and you and the seller (or their authorized representatives) are present for the registration.

- Possession: After registration, you will receive the possession of your new home as per the terms of the Sale Agreement. Conduct a thorough inspection of the property to ensure it’s in the agreed-upon condition.

Step 5: Post-Purchase – Settling In and Planning for the Future

The journey doesn’t end with possession. There are several post-purchase tasks to take care of.

- Home Insurance: Secure comprehensive home insurance to protect your property against unforeseen events like fire, natural disasters, and theft.

- Utilities and Society Membership: Apply for electricity, water, and gas connections. If it’s an apartment complex, become a member of the residents’ association or society and understand the rules and regulations.

- Furnishing and Interior Design: Plan your interiors and furnish your new home to make it your own.

- Property Taxes: Be aware of your annual property tax obligations and ensure timely payments.

- Maintenance: Budget for regular maintenance to keep your property in good condition and preserve its value.

Expert Tips for the Indian Homebuyer:

- Be Patient and Diligent: Buying a home is a significant decision that requires time and effort. Don’t rush the process.

- Seek Professional Advice: Don’t hesitate to consult with experienced real estate agents, lawyers, and financial advisors. Their expertise can save you time, money, and potential headaches.

- Thorough Market Research: Stay informed about the prevailing property trends and price fluctuations in your desired areas.

- Inspect Everything Carefully: Whether it’s a new or resale property, conduct thorough inspections to identify any potential issues.

- Read the Fine Print: Understand all the terms and conditions of the Sale Agreement and loan documents before signing.

- Document Everything: Maintain a proper record of all documents, payments, and communications.

- Trust Your Gut: While logic and research are crucial, don’t ignore your instincts when you find a property that feels right.

The West Bengal Advantage (and Considerations):

The real estate market in West Bengal, particularly in and around Kolkata, offers a unique blend of tradition and modernity. While the fundamental buying process remains similar to other parts of India, there are specific aspects to consider:

- Land Records: Familiarize yourself with the process of verifying land records through the Directorate of Land Records and Surveys, West Bengal.

- Stamp Duty and Registration Charges: Be aware that these rates can vary within West Bengal. Stay updated on the current applicable charges.

- Local Developers: Research the reputation and track record of local developers, especially for under-construction projects.

- Cultural Nuances: Understanding local customs and practices can be beneficial during negotiations and interactions.

- Emerging Markets: Keep an eye on developing areas like Rajarhat, New Town, and the outskirts of Kolkata, which offer potential for appreciation.

Conclusion: Embarking on Your Homeownership Journey with Confidence

Buying a home in India is a significant milestone, a culmination of dreams and hard work. By understanding the process, conducting thorough research, and exercising due diligence, you can navigate this journey with confidence and clarity. Remember to prioritize your needs, plan your finances meticulously, and seek expert guidance when needed.

This guide is your starting point, a compass to direct you through the intricacies of the Indian real estate market. As you embark on this exciting chapter, remember that your dream home is not just a physical space; it’s a place where memories will be made, and your future will unfold. Embrace the journey, stay informed, and take those confident steps towards owning your piece of India. Your dream home awaits!

Good guidance…