India’s real estate market has shown long‑term strength, but Q1 2025 has brought fresh challenges. Ongoing tensions with Pakistan, border disputes with China, trade frictions with Bangladesh and Turkey, plus U.S. tariffs on steel and a weak global economy, all shape buyer sentiment and construction costs. This guide breaks down the latest data, historical lessons, policy support, risks and rewards, and clear recommendations—so you can decide if now is the right time to invest.

Current Market Overview (Q1 2025) in the Context of 2025

Residential Sales Trends

Overall Decline: Sales across India’s top 7 cities fell 28% YoY from 130,000 units in Q1 2024 to 93,280 units in Q1 2025, led by a 49% drop in Hyderabad and 26% in the Mumbai Metropolitan Region (Anarock).

Alternative Data: Another report shows a modest 2% YoY rise to 88,274 units sold, reflecting some data‑source variations (Knight Frank).

Segment Shift:

Premium Homes (≥ ₹1 crore): 46% of all sales in Q1 2025.

Ultra‑Luxury (≥ ₹5 crore): 483% YoY growth, indicating strong high‑net‑worth interest.

Affordable Housing (< ₹50 lakh): Down 9% YoY, as buyers postpone decisions amid uncertainty.

New Launches

Overall Supply: New project launches dropped 10% YoY from 110,865 units to 100,020 units in Q1 2025 (Anarock).

Tech Hubs Hit Hard: Bengaluru and Pune saw a 34% fall in fresh supply, tied to slower IT hiring and tariff‑driven cost pressures.

Office Sector Strength

Leasing Volume: 28.2 million sq ft leased in Q1 2025—a record—driven by Bengaluru (24% share) and Mumbai (Cushman & Wakefield).

Net Absorption: 13.4 million sq ft (20% YoY growth), showing robust occupier demand.

Investment Flows

2024 Totals: USD 8.9 billion deployed across 78 deals—a 51% rise over 2023; 63% came from foreign investors (JLL).

Residential Share: 45% of total investment, underscoring long‑term confidence despite short‑term dips.

Economic Outlook

GDP Growth: India’s economy is projected to grow 6.5–7.0% in FY 2025, underpinning real estate demand (IMF).

Urbanization & Infrastructure: Major highways, rail corridors and urban‑renewal projects continue to enhance connectivity and land values.

Impact of Geopolitical Tensions

India–Pakistan Flare‑Ups

Buyer Caution: Recent cross‑border clashes and “Operation Sindoor” in May 2025 led to a 5–10% drop in North India home sales and a 12% fall in mortgage applications (Economic Times, Moneycontrol).

Project Delays: Up to 10% holdups in border‑state developments in Punjab and Rajasthan due to security clearances.

China Border Disputes

Infrastructure Diversion: The Vibrant Villages Programme (₹7.5 billion per project) boosts border‑area roads and housing—but draws state funds away from other projects (Ministry of Home Affairs).

Material Imports: Surge in Chinese steel imports (up 35.5% YoY) strains domestic producers and drives price volatility (Reuters).

Bangladesh Trade Restrictions

Non‑Tariff Barriers: Yarn import blocks and rice export limits since April 2025 hike costs for Northeast MSMEs and depress land values near border trade hubs by up to 5% during disputes.(Business Today)

India–Turkey Strains

Supply‑Chain Ripples: Boycotts of Turkish marble (₹3,000 cr market) and aviation service pulls (Çelebi Aviation clearance revoked) force builders to seek alternative sources (Reuters).

Hospitality Shift: 60% drop in outbound tourism to Turkey nudges investors toward domestic leisure and hospitality projects.

- US Tariffs: A 26% tariff on Indian goods threatens a US recession, hitting India’s IT sector hard. Bengaluru saw over 50,000 layoffs in 2024, causing a 23% drop in housing sales and a 34% fall in new supply in tech hubs, per (Business Today)

Despite these challenges, India’s market has historically recovered from such shocks, supported by a projected 6.5–7.0% GDP growth in FY2025, government policies like RERA, and strong foreign investment (63% of 2024’s USD 8.9 billion). Emerging sectors remain less sensitive to these risks, offering growth potential.

Impact of Global Economic Factors

U.S. Tariffs & Potential Recession

Imports Taxed: 25% duties on steel and aluminum (effective March 12, 2025) raise Indian rebar costs by ₹1,000–1,500/tonne (2–3% of project budgets) and extend lead times by 4–6 weeks (World Construction Today).

IT Sector Slowdown: A 26% tariff on Indian software services threatens U.S. demand; Nifty IT plunged 9% in one week, leading to 50,000 layoffs in Bengaluru in 2024. This undercuts buyer confidence in tech‑driven cities, where Q1 2025 sales fell 23% and new supply down 34%.

Weak Global Growth

Risk Aversion: Prolonged economic weakness in Western markets makes foreign investors more selective, though India remains comparatively attractive.

Rising Interest Rates

EMI Stress: Although the RBI has signaled a pause, earlier rate hikes increased loan costs, contributing to the 9% drop in affordable housing sales.

Global Capital Flows

FSI & REITs: Despite headwinds, 2024 saw heavy inflows into data‑centers, warehousing and logistics, with new SM‑REITs expanding funding channels.

- Despite uncertainties, foreign investors poured 63% of 2024’s USD 8.9 billion into Indian real estate, showing confidence in its long-term potential. NRIs may benefit from rupee volatility, per Adani Realty.

- Rising Material Costs: Global trade disruptions push up prices for steel and cement, affecting project viability and final property costs.

India’s resilience—bolstered by strong domestic fundamentals and government support—offsets these global pressures, keeping the 2025 outlook cautiously optimistic.

Historical Context: Lessons from the Past

History shows that India’s real estate market weathers geopolitical storms with resilience:

- 1971 Indo-Pak War: Housing approvals in Mumbai fell 12%, and registrations dropped 10%. Commercial vacancies soared in Mumbai’s Fort area and Delhi’s Connaught Place, with hotel occupancy in Delhi below 45%, per SME Futures. Recovery followed once tensions eased.

- 1999 Kargil Conflict: Transaction volumes dipped less than 2%, with rental prices in Delhi and Mumbai falling 3–8%. Luxury homes in Mumbai’s Cuffe Parade ranged from ₹20,000–23,200 per square foot, and office vacancies rose 11–15%. The market rebounded within 6–8 months.

- 2017 Doklam Standoff: Border caution slowed activity, but national residential price growth held at 5.5% YoY.

The pattern? Short-term disruptions—fewer sales, lower rents, and delays—give way to recovery, driven by India’s economic fundamentals like urbanization and liberalization. This resilience is a hopeful sign for 2025.

Government Initiatives & Policy Support

Affordable Housing

PMAY Urban 2.0: ₹10 lakh cr outlay to build 1 crore homes for urban poor and middle class (MoHUA).

Slum Redevelopment: Incentives for private‑public partnerships to upgrade low‑income areas.

FDI Liberalization

100% FDI in townships and integrated development drives foreign capital into large‑scale projects (DPIIT).

Regulatory Reforms

RERA: Boosts transparency, enforces timely delivery, builds buyer trust.

Goods & Services Tax (GST) simplification on construction materials.

Border Infrastructure

Vibrant Villages Programme: Strengthens connectivity in Himalayan and Northeast regions, creating new real estate corridors.

- Highways, rail corridors, and the Vibrant Villages Programme (₹7.5 billion per project in Arunachal Pradesh) spur demand.

Capital‑Market Tools

SM‑REITs: Offer pooled investment vehicles, widening access for smaller investors.

Tax Incentives

Sections 80C and 80TTA: Benefits for long‑term property holders (> 24 months).

Despite potential FDI curbs on border nations, these measures provide a solid foundation, per government sources.

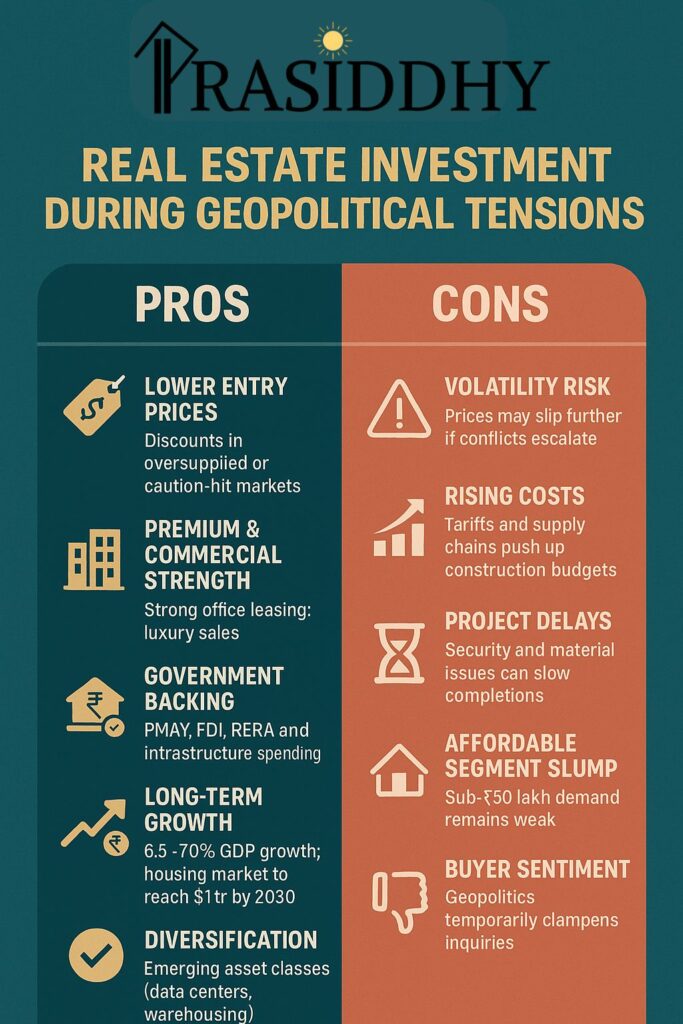

Pros and Cons of Investing in Indian Real Estate in 2025

Investing now is a balancing act. Here’s what to weigh:

Pros

- Lower Prices: Oversupplied markets offer deals, especially with Q1 2025’s sales dip.

- Long-Term Growth: With a USD 1 trillion market by 2030 and 6.5% price growth expected in 2025 Reuters, early investments could pay off.

- Diversification: Real estate hedges against inflation and stock volatility.

- Rental Income: Mid-income rentals in cities like Bengaluru and Mumbai remain steady.

- Premium Segment Boom: Ultra-luxury sales surged 483% YoY, signaling strong demand.

Cons

- Uncertainty: Geopolitical flare-ups could deepen price drops, especially near borders.

- Construction Costs: Rising steel and cement prices (up 2–3% due to tariffs) increase budgets.

- Project Delays: Supply chain issues and border tensions delay completions by up to 10% in some areas.

- Affordable Segment Weakness: A 9% sales drop signals risks in budget housing.

For more insights, see Cushman & Wakefield’s 2025 Outlook.

Recommendations for Investors

Adopt a Long‑Term Horizon

Hold properties > 24 months to access tax benefits and ride out short‑term volatility.

Diversify Across Segments

Balance premium residential, Grade‑A offices, and emerging asset classes (logistics, student housing, health‑tech parks).

Focus on Tier‑1 & Resilient Markets

Mumbai, Bengaluru, Pune and NCR remain top choices; avoid border‑adjacent zones if tensions flare.

Partner with Credible Developers

Prioritize firms with strong delivery records (e.g. DLF, Godrej, Adani Realty).

Monitor Geopolitics & Trade Policies

Stay updated on Indo‑Pak, China border talks, and U.S. tariff changes via reliable news sources.

Leverage Government Schemes

Explore PMAY subsidies, RERA‑registered projects, and FDI‑friendly township deals.

Watch Material Costs

Hedge against steel and cement price rises by negotiating fixed‑rate supply contracts.

Use Data‑Driven Insights

Track unsold inventory and absorption rates (monthly reports by Anarock, Knight Frank, JLL).

- Be Cautious yet Opportunistic: Balance risks with opportunities—buy low in oversupplied areas but research thoroughly.

Conclusion

The Indian real estate market in 2025 is a tale of challenges and opportunities. Q1 saw a 28% residential sales drop amid geopolitical tensions and global economic pressures, yet the office sector, luxury homes, and foreign investment signal resilience. History proves recovery follows disruption, and with a 6.5–7.0% GDP growth forecast, government backing, and a USD 1 trillion horizon by 2030, the long-term outlook is promising. Investors should approach cautiously, diversify wisely, and bet on trusted developers in high-demand areas to turn today’s uncertainties into tomorrow’s gains.